Deutsche Bank completes trial of tokenized investment platform

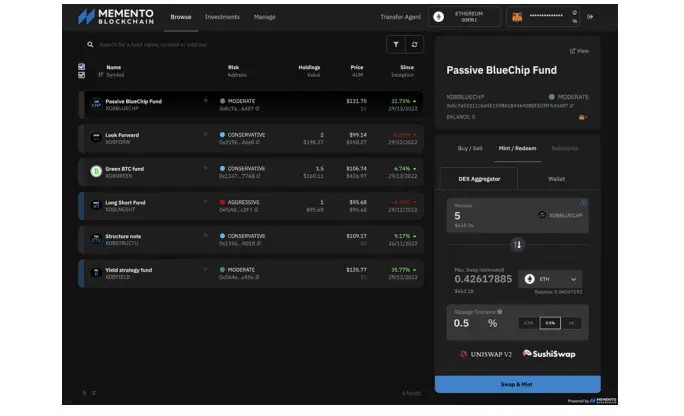

According to a report on Feb. 21, Deutsche Bank Singapore and Memento Blockchain have successfully completed the proof of concept phase of Project DAMA (Digital Assets Management Access), designed to facilitate the management of digital funds investing in tokenized securities. Per its report, asset managers were able to create a digital asset fund with its own soulbound token and launch a direct fiat-to-digital on-ramp for users. Institutional investors could then subscribe to the fund through the direct minting of tokens, via a decentralized exchange aggregator, or through a built-in marketplace.

As the first step, Deutsche Bank and Memento Blockchain created a decentralized finance (DeFi) platform on Ethereum (ETH) and a unique, non-transferable Soulbound Token. Using the SBT, platform developers could then verify the identity of the wallet owner and grant them access to investment opportunities without requiring their personal information each time. Meanwhile, a trust anchor keeps know-your-customer (KYC) checks and accompanying documents off-chain. The SBT could also be used to restrict access to services or products that do not match the underlying users' risk tolerance or experience.

To invest in a fund, the institutional investors holding the SBT would provide collateral in order to mint and receive tokenized shares of the underlying digital investment fund of choice. Tokenized shares can then be swapped via a built-in digital marketplace for digital assets such as stablecoins. As for asset managers, they can create tokenized funds using one-window on Ethereum testnets involving a variety of strategies such as DeFi staking.

For asset security, Deutsche Bank and Memento Blockchain utilized MetaMask for Project DAMA. MetaMask is built into the platform as the digital wallet of the partners' choice for facilitating the transfer of digital assets. Institutional investors would need hold both SBT in their MetaMask and KYC in order to access the platform's decentralized applications. For the next steps, Deustche Bank says it is exploring the use of Project DAMA in Singapore, where there are currently 1,100 registered fund managers with a combined total of $3.36 trillion in assets under management.

Comments

Post a Comment