Bitcoin, Ethereum Eye Major Pullback Risk, Tips Bloomberg Analyst

Also Read: SEC Caused Untold Harm To US; Coinbase CEO After MiCA Approval

Bitcoin Price To Decline More Ahead

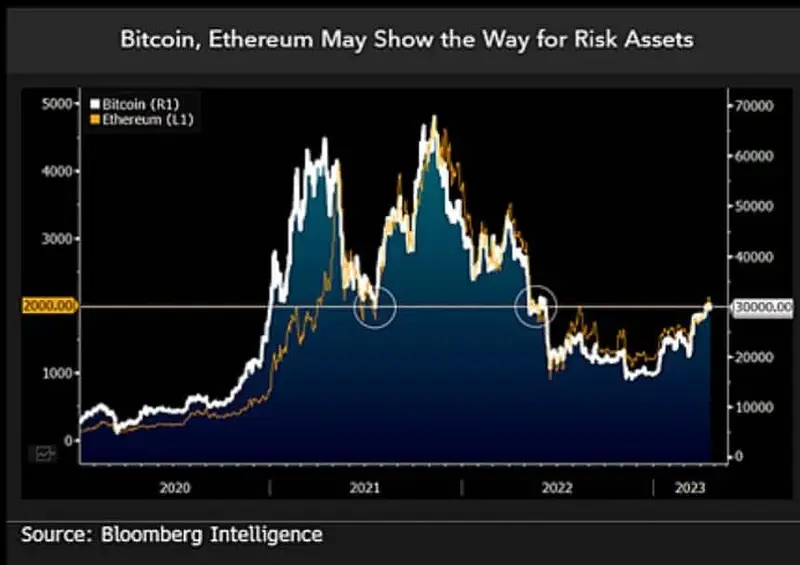

Mike McGlone, Senior Macro Strategist at Bloomberg Intelligence stated Bitcoin (BTC) and Ethereum (ETH) may be running into a wall of resistance ahead. However, Bitcoin price went surged over the $30K level to encounter multiple resistance. Same with ETH, the second largest crypto price breached the $2K level but faced multiple resistances there.

Bloomberg Analyst is still bullish on the biggest of the cryptos in the long term. Meanwhile, a force generated by the dropping stock market in accordance with the tightening Federal Reserve policies leading to recession holds the potential to lower the tide for all the risk assets. He marks Bitcoin and Ethereum among the riskiest assets.

The World’s first licensed Crypto Casino. Begin your journey with 20% cashback up to 10,000 USDT.

Trending Stories

As per the data, $30,000 and $2,000 have been pivotal points for Bitcoin and Ethereum, respectively. McGlone mentioned that the diminishing supply and low and increasing adoption make the bullish case in the long term. However, growing consensus shows that worse is over ahead of a U.S. recession. It is indicated by the yield curve at the highest probability since 1982.

Also Read: Nasdaq-Listed Bitcoin Mining Company Buying Miners Worth Millions

Bitcoin price is down by around 8% in the last 7 days. BTC is trading at an average price of $28,127, at the press time. Its 24 hour trading volume is down by over 2% to stand at $20 billion. While Ethereum price declined by 9% over the past 7 days. ETH is trading at an average price of $1,910, at the press time.